by taxPRO Websites Staff | Aug 6, 2023 | Tax Tips and News

The IRS has constructed a blueprint for its future called the Paperless Processing Initiative. This plan cuts back on paper filing with the purpose of decreasing the number of printed documents it needs to process each year and speeds up tax refunds. Our latest blog post describes these intended changes and what they mean for tax professionals.… Read more about IRS Unveils Timetable for Completely Paperless Filing by 2025 (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

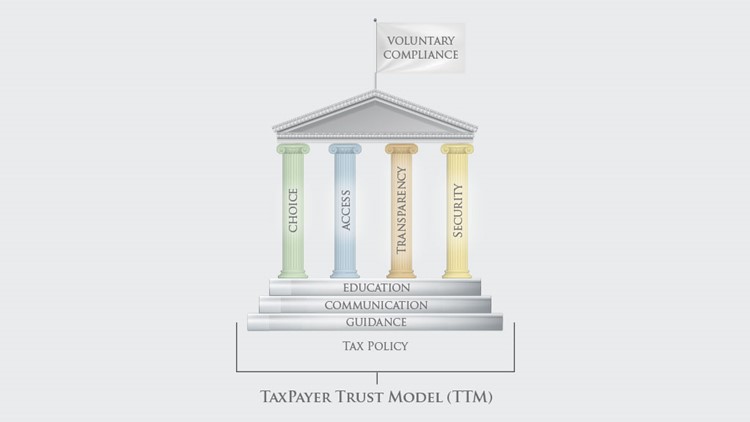

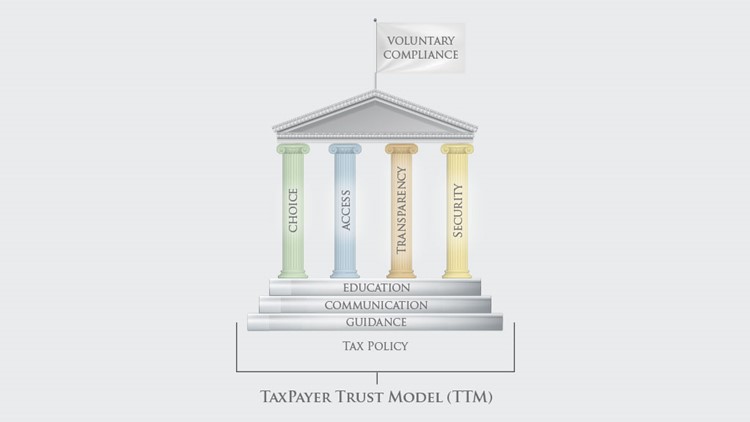

by taxPRO Websites Staff | Jul 19, 2023 | Tax Tips and News

The ETAAC released recommendations to improve electronic income tax filing in their 2023 annual report. The document asks the IRS to update their procedures and details legislation and other recommendations for both Congress and the IRS. Drake Software covers their Taxpayer Trust Model and the proposed changes in our recent blog post.… Read more about ETAAC Lays Out its 2023 Recommendations (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | Jun 13, 2023 | Tax Tips and News

Weeks of record flooding and mountain snows brought on by an “atmospheric river” in California resulted in a federal disaster declaration from the Federal Emergency Management Agency (FEMA). While disaster victims received tax relief from filing and payment deadlines, some were confused after receiving notices from the Internal Revenue Service.… Read more about Calif. Disaster Victims Report Confusion Following IRS Notice (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | Jun 9, 2023 | Tax Tips and News

A new wave of advertising is churning up interest in a tax credit intended to help businesses and non-profits that tried to retain their employees during the COVID-19 pandemic. However, the ads on TV and radio, online, and even direct mail leave out a critical fact: most of the promoters’ clients won’t qualify for the credit.… Read more about Real Facts About Bogus Claims for the Employee Retention Credit (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

by taxPRO Websites Staff | May 26, 2023 | Tax Tips and News

The Internal Revenue Service is moving ahead with a program that will offer taxpayers a new option on for filing their 2023 returns next year. Dubbed “Direct File,” a scaled-down version of the full program will allow taxpayers to file online for free, using an IRS-run website.… Read more about Direct File Pilot to Debut Next Tax Season (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…